In the world of finance, precision is paramount, and this is where the concept of basis points comes into play. Basis points are a unit of measurement that allows analysts, investors, and financial professionals to discuss changes in interest rates or other financial percentages with greater accuracy. A single basis point is equal to one one-hundredth of a percentage point, making it a critical term in various financial contexts. As interest rates fluctuate and market conditions evolve, understanding basis points becomes essential for making informed decisions. This article will delve into the significance of basis points, how they are used in financial transactions, and what implications they have for investors and borrowers alike.

Many financial discussions revolve around the adjustments in rates that can significantly impact loan terms, investment returns, and overall economic health. By breaking down these changes into basis points, financial professionals can communicate more effectively, avoiding the ambiguity that can arise from talking about percentages alone. Moreover, as we explore this topic, it’s crucial to understand who uses basis points and in what contexts they are most relevant. This article aims to provide clarity on these questions and more.

Whether you're a seasoned investor or just beginning to navigate the financial landscape, grasping the concept of basis points is fundamental. With the right knowledge, you can better understand market trends, make informed investment decisions, and comprehend the financial implications of rate changes. Let’s embark on this journey to demystify basis points and unveil their importance in the financial world.

What Are Basis Points?

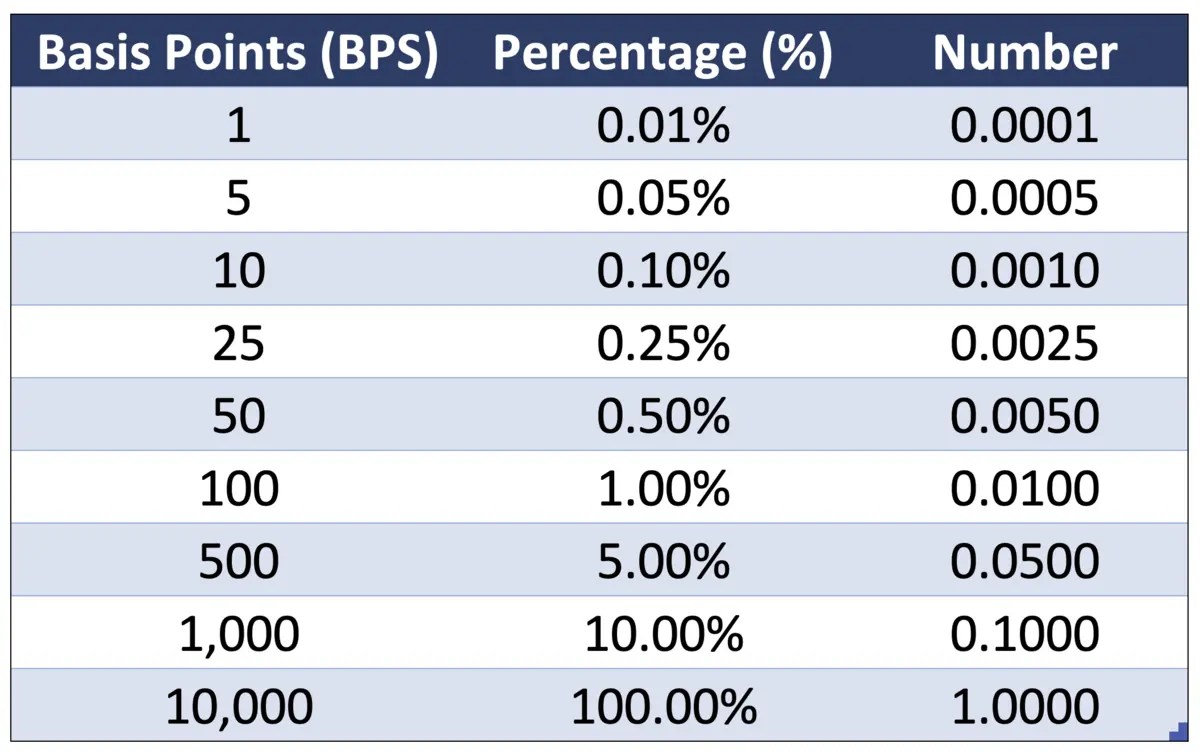

Basis points, often abbreviated as bps, are a critical measurement in finance that helps quantify changes in interest rates, bond yields, and other financial ratios. One basis point equals 0.01%, which means that a shift from 3.00% to 3.01% represents a change of one basis point, while a shift from 3.00% to 3.50% signifies a change of fifty basis points. This precise measurement allows for clearer communication and understanding when discussing financial adjustments that might otherwise seem small but can have significant impacts.

How Are Basis Points Used in Financial Markets?

In financial markets, basis points are used extensively in various contexts, including:

- Interest Rate Changes: Central banks often alter interest rates in basis points to control inflation and stimulate economic growth.

- Bond Pricing: When bond yields change, these variations are often expressed in basis points to denote shifts in investor returns.

- Loan Agreements: When lenders adjust rates for loans, they often do so in basis points, making it easier for borrowers to understand the impact of these changes.

- Investment Returns: Portfolio managers may express performance changes in basis points to clarify the effectiveness of their strategies.

Why Are Basis Points Important?

Basis points are crucial because they provide clarity and precision in financial discussions. When dealing with large sums of money, even a slight change in percentage can translate into significant financial implications. For instance, a 25 basis point increase in interest rates can impact mortgage payments, investment returns, and overall economic conditions. Therefore, understanding and utilizing basis points helps investors and borrowers navigate the financial landscape more effectively.

How Do Basis Points Affect Borrowers?

For borrowers, basis points can play a significant role in determining the cost of loans. A change in interest rates expressed in basis points can directly influence monthly payments, total interest paid over the life of the loan, and the overall affordability of borrowing. For example, if a mortgage rate increases from 3.00% to 3.25%, that 25 basis point increase can make a noticeable difference in monthly payments, which can impact the borrower’s budget and financial planning.

What Role Do Basis Points Play in Investment Strategies?

Investors also need to pay close attention to basis points as they can affect the returns on investments. When evaluating bonds, stocks, or other financial instruments, a change in yields expressed in basis points can help investors gauge market sentiment and make informed decisions. For example, a bond that yields 4.00% versus one yielding 4.50% represents a 50 basis point difference, which can significantly affect an investor's choice based on risk tolerance and return expectations.

How Are Basis Points Calculated?

Calculating basis points is relatively straightforward. To convert a percentage change into basis points, you simply multiply the percentage by 100. For instance, if an interest rate increases from 2.50% to 3.00%, the change is 0.50%. To express this change in basis points, you multiply 0.50 by 100, resulting in a change of 50 basis points. This easy calculation allows financial professionals to quickly assess and communicate changes in rates.

Can Basis Points Predict Economic Trends?

Yes, basis points can serve as indicators of broader economic trends. When central banks adjust interest rates in basis points, it reflects their outlook on inflation, employment, and economic growth. For example, an increase in basis points may signal that a central bank is attempting to curb inflation, while a decrease might indicate efforts to stimulate growth. By monitoring these changes, analysts and investors can gain insights into future economic conditions.

How Do Basis Points Impact the Stock Market?

The stock market is also sensitive to changes in basis points. When interest rates rise, borrowing costs increase for companies, which can lead to lower profits and, subsequently, lower stock prices. Conversely, a decrease in interest rates can stimulate investment and spending, potentially boosting stock prices. This relationship highlights the interconnectedness of the bond and stock markets and the importance of monitoring basis points for investment strategies.

Conclusion: The Significance of Understanding Basis Points

In conclusion, understanding basis points is essential for anyone involved in finance, whether you're a borrower, investor, or financial professional. By grasping the concept of basis points, you can better navigate the complexities of interest rates, investment returns, and economic trends. As we continue to see fluctuations in financial markets, being knowledgeable about basis points will enable you to make informed decisions and engage in meaningful financial discussions.